Attorney-Verified Articles of Incorporation Document for the State of Arizona

The Arizona Articles of Incorporation form serves as a foundational document for individuals or groups looking to establish a corporation within the state. This form is crucial for legally recognizing a business entity and provides essential information about the corporation, including its name, duration, and purpose. Additionally, it outlines the details regarding the corporation's registered agent, who will act as the official point of contact for legal matters. The form requires the identification of the incorporators, who are responsible for filing the document, and it may also include provisions for the management structure, whether it be a board of directors or other governing body. Furthermore, the Articles of Incorporation may specify the types of shares the corporation is authorized to issue, which is vital for understanding ownership and investment opportunities. By completing and submitting this form to the Arizona Corporation Commission, a business can gain legal recognition, allowing it to operate within the state and engage in various commercial activities.

Key takeaways

When filling out and using the Arizona Articles of Incorporation form, there are several important points to consider. Understanding these can help ensure a smooth incorporation process.

- Accurate Information: It's crucial to provide accurate details about your business, including the name, address, and purpose. Any errors may lead to delays or complications.

- Registered Agent Requirement: Every corporation in Arizona must designate a registered agent. This person or business is responsible for receiving legal documents on behalf of the corporation.

- Filing Fees: Be aware that there are fees associated with filing the Articles of Incorporation. These fees can vary based on the type of corporation and the method of filing.

- Publication Requirement: After filing, Arizona law requires that you publish a notice of your incorporation in a newspaper for three consecutive weeks. This step is essential for legal compliance.

By keeping these key takeaways in mind, you can navigate the process of incorporating your business in Arizona more effectively.

How to Use Arizona Articles of Incorporation

Once you have gathered the necessary information, you can begin the process of completing the Arizona Articles of Incorporation form. This form is essential for officially establishing your corporation in Arizona. Follow the steps below to ensure that you fill it out correctly.

- Obtain the Arizona Articles of Incorporation form. You can find it on the Arizona Corporation Commission's website or request a physical copy.

- Provide the name of your corporation. Ensure that the name complies with Arizona naming requirements and is not already in use.

- List the corporation's principal office address. This should be a physical address where the corporation will conduct business.

- Designate a statutory agent. This person or entity will be responsible for receiving legal documents on behalf of the corporation. Include their name and address.

- Specify the purpose of the corporation. A brief description of the business activities is sufficient.

- Indicate the number of shares the corporation is authorized to issue. If applicable, specify the classes of shares and their respective rights.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. The incorporators must sign to validate the document.

- Submit the completed form to the Arizona Corporation Commission. You can file online or send it by mail, along with the required filing fee.

After submitting the Articles of Incorporation, you will receive confirmation from the Arizona Corporation Commission. This confirmation will indicate that your corporation has been officially established. Be sure to keep a copy of the filed documents for your records.

Similar forms

The Articles of Incorporation for Arizona is similar to the Certificate of Incorporation used in many other states. Both documents serve as the foundational legal paperwork required to establish a corporation. They outline essential details such as the corporation's name, purpose, and the number of shares it is authorized to issue. This similarity ensures that both documents create a legal entity recognized by the state, allowing for limited liability protection for the owners.

Another comparable document is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws govern its internal management. They detail the rules and procedures for operating the corporation, including how meetings are conducted and how decisions are made. Together, these documents provide a comprehensive framework for both the legal and operational aspects of the corporation.

The Operating Agreement for limited liability companies (LLCs) is also akin to the Articles of Incorporation. Like the Articles, it is a foundational document, but it applies specifically to LLCs. The Operating Agreement outlines the management structure, ownership percentages, and operational procedures of the LLC. Both documents serve to formalize the business structure and protect the owners’ personal assets from business liabilities.

In addition, the Partnership Agreement is similar in function to the Articles of Incorporation, but it pertains to partnerships rather than corporations. This document defines the roles, responsibilities, and profit-sharing arrangements among partners. Like the Articles, it establishes a legal framework for the business but focuses on the relationships between individuals rather than a corporate entity.

The Certificate of Formation is another document that parallels the Articles of Incorporation. Used in various states, this document serves a similar purpose in establishing a business entity. It includes essential information such as the business name, address, and registered agent. Both the Certificate of Formation and the Articles of Incorporation are crucial for legally recognizing a business in its respective state.

The Statement of Information, often required in conjunction with the Articles of Incorporation, provides updated information about a corporation’s key officers and business address. This document is essential for maintaining transparency and compliance with state regulations. It complements the Articles by ensuring that the state has current information about the corporation’s management and operations.

The Business License Application is another document that shares similarities with the Articles of Incorporation. While the Articles create the legal entity, the Business License Application allows the business to operate legally within a specific jurisdiction. Both documents are necessary for compliance with state and local regulations, ensuring that the business is recognized and permitted to conduct its activities.

The Federal Employer Identification Number (EIN) application is also relevant. While not a formation document, obtaining an EIN is essential for tax purposes once the Articles of Incorporation are filed. This number identifies the corporation for tax reporting and payroll. Both documents are integral to the establishment and operation of a business, facilitating compliance with federal tax laws.

Lastly, the Certificate of Good Standing is a document that can be seen as a follow-up to the Articles of Incorporation. Once a corporation is established, this certificate verifies that it is compliant with state regulations and has fulfilled all necessary obligations. It serves as proof of the corporation's legal status and is often required for business transactions, loans, or contracts.

Document Preview Example

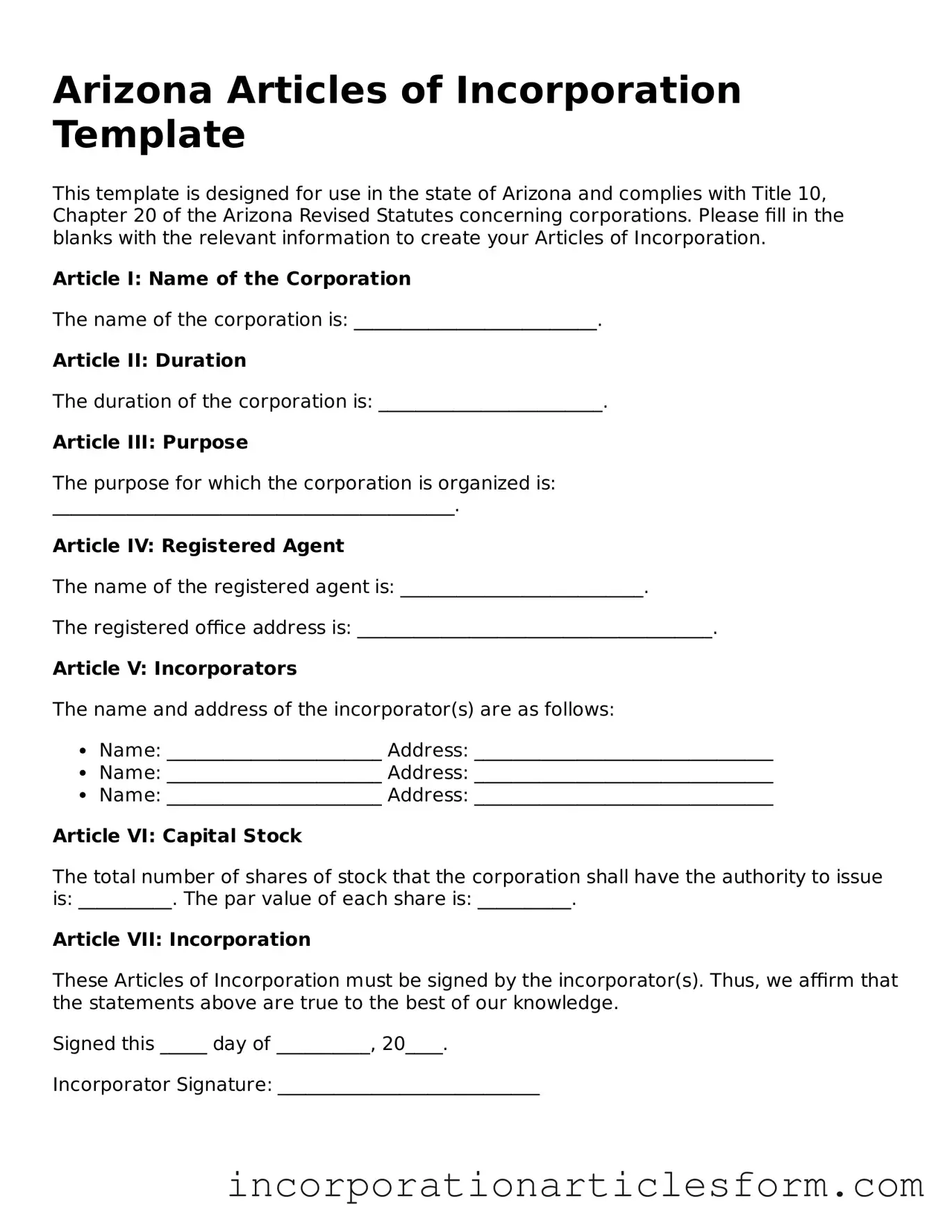

Arizona Articles of Incorporation Template

This template is designed for use in the state of Arizona and complies with Title 10, Chapter 20 of the Arizona Revised Statutes concerning corporations. Please fill in the blanks with the relevant information to create your Articles of Incorporation.

Article I: Name of the Corporation

The name of the corporation is: __________________________.

Article II: Duration

The duration of the corporation is: ________________________.

Article III: Purpose

The purpose for which the corporation is organized is: ___________________________________________.

Article IV: Registered Agent

The name of the registered agent is: __________________________.

The registered office address is: ______________________________________.

Article V: Incorporators

The name and address of the incorporator(s) are as follows:

- Name: _______________________ Address: ________________________________

- Name: _______________________ Address: ________________________________

- Name: _______________________ Address: ________________________________

Article VI: Capital Stock

The total number of shares of stock that the corporation shall have the authority to issue is: __________. The par value of each share is: __________.

Article VII: Incorporation

These Articles of Incorporation must be signed by the incorporator(s). Thus, we affirm that the statements above are true to the best of our knowledge.

Signed this _____ day of __________, 20____.

Incorporator Signature: ____________________________

Some Other Articles of Incorporation State Forms

Articles of Organization Kentucky - Includes statements regarding liability limitations for directors.

Nebraska Articles of Incorporation - It may include details about how stock will be marketed and transferred.

Mississippi Llc Requirements - This document may be used to specify restrictions on the transfer of shares.

Division of Corporations Alaska - It may require a filing fee, which varies by state.