Attorney-Verified Articles of Incorporation Document for the State of Connecticut

When starting a business in Connecticut, one of the first steps involves completing the Articles of Incorporation form, a crucial document that lays the foundation for your corporation. This form serves several key purposes, including establishing your business's legal identity and providing essential information to the state. Among the major aspects included in the form are the corporation's name, which must be unique and comply with state regulations, and the purpose of the corporation, detailing the nature of the business activities it will engage in. Additionally, the form requires the designation of a registered agent, a person or entity responsible for receiving legal documents on behalf of the corporation. The number of shares the corporation is authorized to issue, along with their par value, must also be specified, as this directly impacts the ownership structure. Furthermore, the Articles of Incorporation include provisions for the corporation's management structure, outlining whether it will be managed by directors or members. Completing this form accurately is vital, as it not only facilitates the incorporation process but also ensures compliance with state laws, setting the stage for a successful business venture.

Key takeaways

Filling out and using the Connecticut Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They officially establish your business as a legal entity in Connecticut.

- Gather Required Information: Before starting, collect necessary details such as the corporation's name, purpose, and the names and addresses of the initial directors.

- Choose an Appropriate Name: The name of your corporation must be unique and not already in use by another entity in Connecticut. It should also include a designation like "Corporation," "Incorporated," or "Limited."

- Specify the Corporate Purpose: Clearly define the purpose of your corporation. While you can be broad, ensure it aligns with state guidelines.

- Include Registered Agent Information: Designate a registered agent who will receive legal documents on behalf of the corporation. This agent must have a physical address in Connecticut.

- Determine the Duration: Indicate whether your corporation will exist indefinitely or for a specified period. Most choose indefinite duration for flexibility.

- Filing Fee: Be prepared to pay the required filing fee when submitting your Articles of Incorporation. This fee can vary, so check the latest rates.

- Review for Accuracy: Double-check all information for accuracy before submission. Errors can lead to delays or rejection of your application.

- Follow Up: After submission, monitor the status of your filing. Once approved, you will receive a certificate of incorporation, which is essential for operating your business.

How to Use Connecticut Articles of Incorporation

After completing the Connecticut Articles of Incorporation form, you will submit it to the Secretary of the State's office along with the required filing fee. Ensure that all information is accurate to avoid delays in processing. Below are the steps to fill out the form properly.

- Begin by providing the name of your corporation. Ensure that it is unique and adheres to state naming requirements.

- Indicate the purpose of the corporation. Be clear and concise about the business activities you plan to engage in.

- Fill in the principal office address. This should be a physical address in Connecticut, not a P.O. Box.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue. Include the par value of the shares if applicable.

- Provide the names and addresses of the incorporators. At least one incorporator must sign the form.

- Review all entries for accuracy and completeness before signing the form. Ensure that all required signatures are present.

- Calculate the filing fee based on the current fee schedule and prepare payment. Check acceptable payment methods.

- Submit the completed form and payment to the Secretary of the State’s office, either by mail or in person.

Similar forms

The Articles of Incorporation in Connecticut serve a similar purpose to the Certificate of Incorporation, which is often used interchangeably in various jurisdictions. Both documents establish a corporation as a legal entity, outlining essential information such as the corporation's name, purpose, and the number of shares it is authorized to issue. The Certificate of Incorporation typically provides a more streamlined approach, but both documents ultimately fulfill the same function of creating a corporation under state law.

Another document akin to the Articles of Incorporation is the Bylaws. While the Articles of Incorporation lay the groundwork for the corporation's existence, the Bylaws govern its internal operations. Bylaws detail how the corporation will be managed, including the roles of officers and directors, meeting procedures, and voting rights. This distinction is crucial, as the Articles serve as the foundational charter, while Bylaws provide the operational blueprint.

The Limited Liability Company (LLC) Articles of Organization are also comparable to the Articles of Incorporation. Both documents are required to formally establish a business entity. However, the Articles of Organization are specific to LLCs, which provide owners with limited liability protection while allowing for more flexible management structures. This document includes the name of the LLC, its principal address, and the names of its members, paralleling the information required in Articles of Incorporation.

The Partnership Agreement is another related document, especially when considering business structures. While the Articles of Incorporation create a corporation, a Partnership Agreement governs the relationship between partners in a partnership. This agreement outlines each partner's contributions, responsibilities, and the distribution of profits and losses. Both documents aim to clarify the structure and operational guidelines of a business, albeit in different contexts.

Similar to the Articles of Incorporation is the Certificate of Good Standing, which is often required by banks and other entities to verify that a corporation is legally recognized and compliant with state regulations. While the Articles of Incorporation establish the corporation, the Certificate of Good Standing confirms that it is active and has fulfilled all necessary legal obligations, such as filing annual reports and paying taxes.

The Statement of Information is another document that shares similarities with the Articles of Incorporation. Required in some states, this document provides updated information about a corporation, including its address, officers, and business activities. While the Articles serve as the initial filing to create the corporation, the Statement of Information is often a periodic requirement to ensure that the state has current information about the entity.

The Operating Agreement, while specific to LLCs, bears similarities to the Articles of Incorporation. This document outlines the management structure and operational procedures of the LLC. Like the Articles, the Operating Agreement is essential for defining the rights and responsibilities of the owners, although it is tailored to the unique characteristics of an LLC rather than a corporation.

The Corporate Resolution is another document that aligns with the Articles of Incorporation in that it formalizes decisions made by the corporation's board of directors or shareholders. While the Articles establish the corporation's existence, Corporate Resolutions document specific actions taken by the corporation, such as approving contracts or authorizing bank accounts, thus ensuring that the corporation operates within its defined legal framework.

Finally, the Annual Report is a document that, while not required at the time of incorporation, is essential for maintaining a corporation’s good standing. This report provides updated information about the corporation's financial status, directors, and business activities. Like the Articles of Incorporation, the Annual Report serves to keep the state informed about the corporation, ensuring ongoing compliance with legal requirements.

Document Preview Example

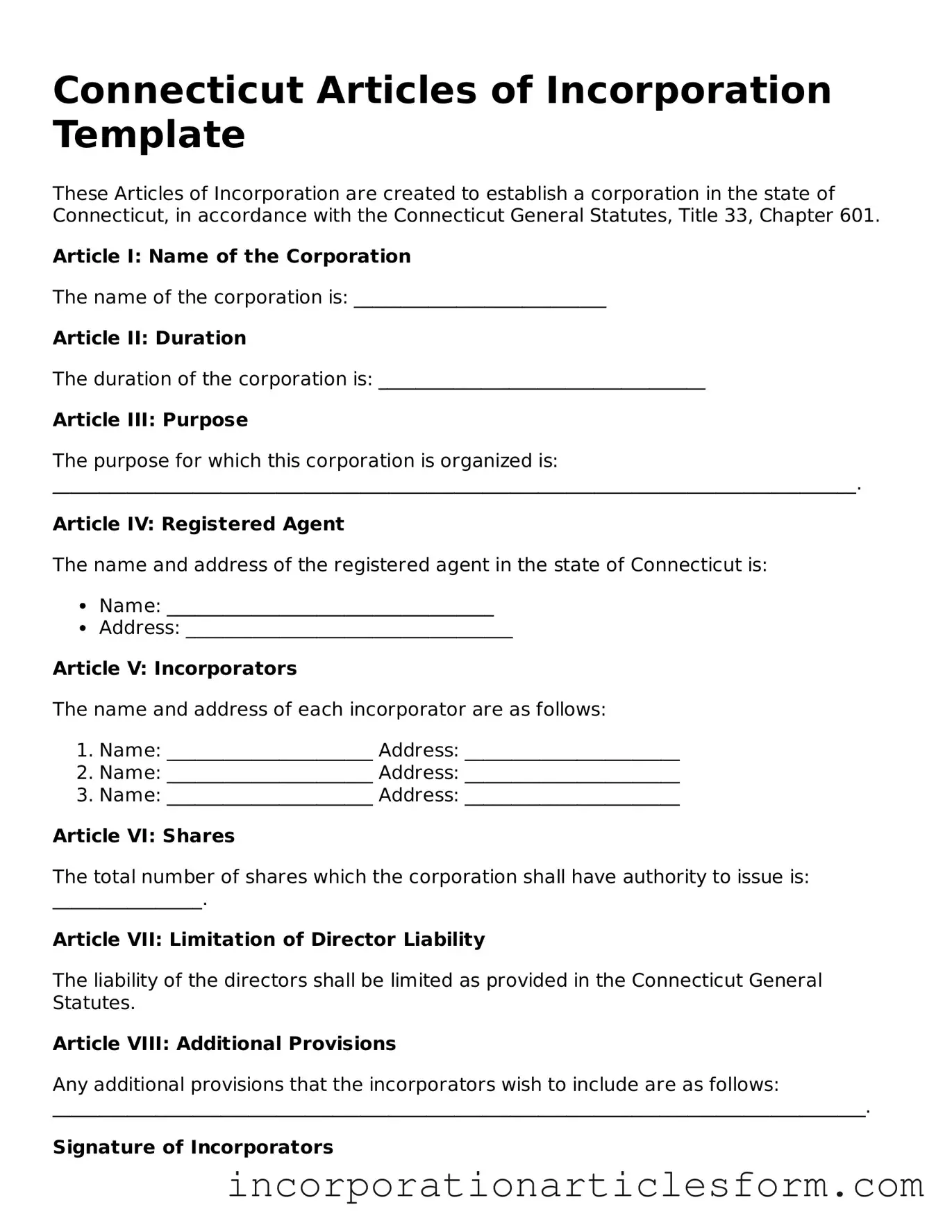

Connecticut Articles of Incorporation Template

These Articles of Incorporation are created to establish a corporation in the state of Connecticut, in accordance with the Connecticut General Statutes, Title 33, Chapter 601.

Article I: Name of the Corporation

The name of the corporation is: ___________________________

Article II: Duration

The duration of the corporation is: ___________________________________

Article III: Purpose

The purpose for which this corporation is organized is: ______________________________________________________________________________________.

Article IV: Registered Agent

The name and address of the registered agent in the state of Connecticut is:

- Name: ___________________________________

- Address: ___________________________________

Article V: Incorporators

The name and address of each incorporator are as follows:

- Name: ______________________ Address: _______________________

- Name: ______________________ Address: _______________________

- Name: ______________________ Address: _______________________

Article VI: Shares

The total number of shares which the corporation shall have authority to issue is: ________________.

Article VII: Limitation of Director Liability

The liability of the directors shall be limited as provided in the Connecticut General Statutes.

Article VIII: Additional Provisions

Any additional provisions that the incorporators wish to include are as follows: _______________________________________________________________________________________.

Signature of Incorporators

We, the undersigned incorporators, hereby affirm that the facts stated herein are true, under penalty of law.

- Signature: _________________________ Date: _______________

- Signature: _________________________ Date: _______________

- Signature: _________________________ Date: _______________

IN WITNESS WHEREOF, the incorporators have executed these Articles of Incorporation on this ___ day of __________, 20__.

Some Other Articles of Incorporation State Forms

Ny Dos Business Search - They provide a framework for governance, including information on directors and officers.

Secretary of State Idaho - Annual shareholder meetings and voting procedures can be defined within the articles.

South Dakota Llc Registration - Lists the names and addresses of the initial directors.