Attorney-Verified Articles of Incorporation Document for the State of Florida

In the vibrant landscape of Florida's business environment, the Articles of Incorporation form serves as a foundational document for establishing a corporation. This essential form outlines key details about the corporation, including its name, principal office address, and the purpose for which it is being formed. Additionally, it requires the identification of the registered agent, who will serve as the point of contact for legal documents. The form also specifies the number of shares the corporation is authorized to issue, providing clarity on ownership structure. By completing this form accurately, entrepreneurs can ensure compliance with state regulations and lay the groundwork for their business operations. Understanding the nuances of the Articles of Incorporation is crucial for anyone looking to navigate the corporate landscape in Florida effectively.

Key takeaways

Filling out and using the Florida Articles of Incorporation form is a crucial step in establishing a corporation in the state. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They outline essential details such as the corporation's name, purpose, and structure.

- Choose a Unique Name: The name of your corporation must be distinguishable from existing entities registered in Florida. Conduct a name search through the Florida Division of Corporations to ensure your desired name is available.

- Designate a Registered Agent: A registered agent is required to receive legal documents on behalf of the corporation. This agent must have a physical address in Florida and be available during business hours.

- Specify the Corporate Purpose: Clearly define the purpose of your corporation. This can be broad, but it should reflect the nature of your business activities.

- Include Incorporator Information: The Articles must include the name and address of the incorporator(s). This individual is responsible for filing the Articles and can be anyone involved in forming the corporation.

- Decide on Share Structure: If your corporation will issue shares, specify the total number of shares and their par value. This information is vital for understanding ownership and investment potential.

- File with the State: Submit the completed Articles of Incorporation to the Florida Division of Corporations along with the required filing fee. Ensure all information is accurate to avoid delays.

- Obtain an Employer Identification Number (EIN): After incorporation, apply for an EIN through the IRS. This number is essential for tax purposes and hiring employees.

- Maintain Compliance: Once your corporation is established, stay informed about ongoing compliance requirements, including annual reports and fees. This will help avoid penalties and keep your corporation in good standing.

By following these key points, you can navigate the process of completing and utilizing the Florida Articles of Incorporation effectively. Taking the time to ensure accuracy and compliance will set a solid foundation for your new corporation.

How to Use Florida Articles of Incorporation

After you have gathered all necessary information, you can proceed to fill out the Florida Articles of Incorporation form. This document is essential for officially establishing your corporation in Florida. Ensure you have accurate details ready to avoid any delays in the process.

- Begin by downloading the Florida Articles of Incorporation form from the Florida Division of Corporations website.

- Enter the name of your corporation. Ensure it complies with Florida naming requirements.

- Provide the principal office address. This must be a physical address in Florida.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- Fill in the number of shares the corporation is authorized to issue. Specify the classes of shares if applicable.

- Include the names and addresses of the incorporators. At least one person must sign the form.

- Sign and date the form. Ensure that the signature is from an incorporator or authorized person.

- Prepare the filing fee. Check the current fee amount on the Florida Division of Corporations website.

- Submit the completed form and payment to the Florida Division of Corporations, either online or by mail.

Once submitted, you will receive confirmation of your filing. Keep this confirmation for your records. It may take several days to process your application, after which you will officially have your corporation registered in Florida.

Similar forms

The Articles of Organization is a document used to establish a Limited Liability Company (LLC) in Florida. Like the Articles of Incorporation, it outlines essential details about the business, including its name, address, and the names of its members or managers. Both documents serve as foundational legal filings that create a separate legal entity, providing liability protection to the owners. The process of filing these documents is similar, requiring submission to the Florida Division of Corporations and payment of a filing fee.

The Bylaws are another important document for corporations. While the Articles of Incorporation establish the company’s existence, the Bylaws outline how the corporation will operate. This includes rules for meetings, voting procedures, and the roles of officers and directors. Both documents are crucial for governance, but the Bylaws provide the internal framework that guides day-to-day operations, whereas the Articles focus on the formal creation of the entity.

The Certificate of Good Standing is similar in that it verifies a corporation's compliance with state requirements. This document is often required when a business wants to operate in another state or secure financing. While the Articles of Incorporation initiate a corporation, the Certificate of Good Standing confirms that the corporation is active and has met all necessary obligations, such as filing annual reports and paying taxes.

The Statement of Information is a document that some states require corporations to file periodically. It provides updated information about the business, including addresses and officer details. Similar to the Articles of Incorporation, it ensures that the state has current records. However, the Statement of Information is typically filed after the corporation is established, while the Articles are part of the formation process.

The Partnership Agreement is relevant for partnerships, outlining the terms and conditions between partners. Like the Articles of Incorporation, it serves to clarify the structure of the business and the roles of each partner. Both documents are essential for establishing the legal framework of the business, ensuring that all parties understand their rights and responsibilities.

The Operating Agreement is crucial for LLCs, detailing the management structure and operational guidelines. Similar to the Bylaws for corporations, the Operating Agreement outlines how the LLC will function. Both documents help prevent disputes by providing clear rules and expectations for members or managers involved in the business.

The Business License is a document that allows a company to operate legally within a specific jurisdiction. While the Articles of Incorporation create the business entity, the Business License is often required to conduct business activities. Both documents are essential for legal compliance, but the Business License focuses on local regulations, whereas the Articles pertain to state-level incorporation.

The Tax Identification Number (TIN) or Employer Identification Number (EIN) is necessary for tax purposes. Similar to the Articles of Incorporation, obtaining a TIN is a crucial step in the business formation process. Both documents help establish the business as a legal entity, but the TIN specifically enables the business to pay taxes and hire employees, ensuring compliance with federal regulations.

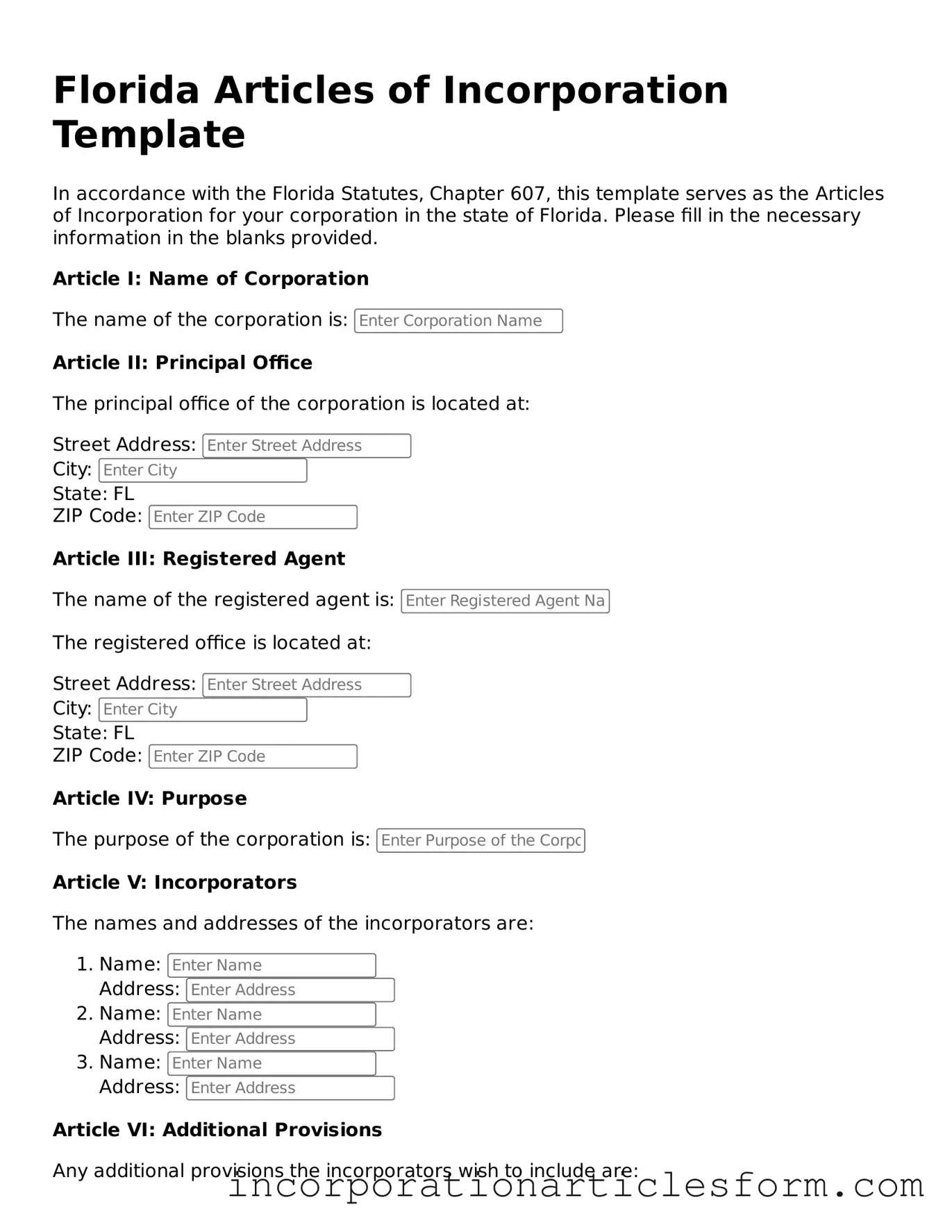

Document Preview Example

Florida Articles of Incorporation Template

In accordance with the Florida Statutes, Chapter 607, this template serves as the Articles of Incorporation for your corporation in the state of Florida. Please fill in the necessary information in the blanks provided.

Article I: Name of Corporation

The name of the corporation is:

Article II: Principal Office

The principal office of the corporation is located at:

Street Address:

City:

State: FL

ZIP Code:

Article III: Registered Agent

The name of the registered agent is:

The registered office is located at:

Street Address:

City:

State: FL

ZIP Code:

Article IV: Purpose

The purpose of the corporation is:

Article V: Incorporators

The names and addresses of the incorporators are:

- Name:

Address: - Name:

Address: - Name:

Address:

Article VI: Additional Provisions

Any additional provisions the incorporators wish to include are:

Article VII: Signature

Each incorporator must sign below:

Signature of Incorporator:

Date:

This template is designed for informational purposes. Always consider consulting with a qualified professional for assistance specific to your circumstances.

Some Other Articles of Incorporation State Forms

Virginia Business License Cost - Shareholders and directors are identified in the Articles of Incorporation.

Articles of Organization Massachusetts - Articles of Incorporation establish a business as a legal entity.