Attorney-Verified Articles of Incorporation Document for the State of Kentucky

When starting a business in Kentucky, one of the first steps you'll encounter is filing the Articles of Incorporation. This essential document lays the groundwork for your corporation, establishing its legal existence in the state. The form requires specific information, including the name of the corporation, which must be unique and compliant with state naming rules. You’ll also need to provide the purpose of your business, which can be a general statement or a more detailed description. Additionally, the form asks for the address of your principal office and the name and address of your registered agent—someone who will receive legal documents on behalf of the corporation. It's crucial to include the number of shares the corporation is authorized to issue, as this can affect future fundraising efforts. Lastly, the Articles of Incorporation must be signed by the incorporators, who are responsible for setting up the corporation. Understanding these components is vital for ensuring a smooth incorporation process and for laying a solid foundation for your business's future.

Key takeaways

Filling out the Kentucky Articles of Incorporation form is a crucial step in starting your business. Here are some key takeaways to keep in mind:

- Ensure you have a unique business name. The name must not be the same as any existing corporation in Kentucky.

- Include the purpose of your corporation. Be clear and concise about what your business will do.

- Designate a registered agent. This person or business will receive legal documents on behalf of your corporation.

- Provide the principal office address. This should be a physical location, not just a P.O. Box.

- List the names and addresses of the incorporators. These individuals will be responsible for setting up the corporation.

- Decide on the number of shares the corporation will issue. This is important for ownership and investment purposes.

- File the form with the Kentucky Secretary of State. This can often be done online, but be mindful of the filing fees.

- Keep a copy of the filed Articles of Incorporation. This document is essential for your business records and future legal needs.

Acting promptly on these steps can help ensure a smooth incorporation process. It’s essential to get it right from the start to avoid complications later on.

How to Use Kentucky Articles of Incorporation

Filling out the Kentucky Articles of Incorporation form is an important step in starting your business. Once you complete the form, you'll be one step closer to officially establishing your corporation in the state. Make sure to have all the necessary information ready before you begin, as this will streamline the process.

- Download the Form: Visit the Kentucky Secretary of State's website to download the Articles of Incorporation form.

- Provide the Corporation Name: Enter the name of your corporation. Ensure it complies with Kentucky naming requirements, including the inclusion of "Corporation," "Incorporated," or an abbreviation like "Inc."

- List the Principal Office Address: Fill in the complete street address of your corporation's main office. Include the city, state, and zip code.

- Identify the Registered Agent: Provide the name and address of your registered agent. This person or business will receive legal documents on behalf of your corporation.

- State the Purpose: Briefly describe the purpose of your corporation. This can be a general statement about the nature of your business.

- Incorporator Information: Enter the name and address of the incorporator(s). This is the individual(s) responsible for filing the Articles of Incorporation.

- Specify the Number of Shares: Indicate the total number of shares the corporation is authorized to issue.

- Sign the Form: Ensure that the incorporator(s) sign and date the form. This is crucial for the validity of the document.

- Submit the Form: File the completed form with the Kentucky Secretary of State, either online or by mail, along with the required filing fee.

After you submit the Articles of Incorporation, the state will review your application. If everything is in order, you'll receive confirmation of your corporation's formation. Keep an eye on your email or mailbox for any correspondence from the Secretary of State.

Similar forms

The Kentucky Articles of Incorporation form is similar to the Articles of Organization used for Limited Liability Companies (LLCs). Both documents serve as foundational filings that establish a business entity with the state. While the Articles of Incorporation outlines the creation of a corporation, the Articles of Organization does the same for an LLC. Each document typically includes essential information such as the business name, registered agent, and the purpose of the business, ensuring that the entity is recognized legally and can operate within the state.

Another document that shares similarities is the Certificate of Incorporation, which is used in many states, including Kentucky. Like the Articles of Incorporation, this certificate is a formal declaration that a corporation has been established. It includes similar details such as the corporation's name, address, and the number of shares authorized for issuance. The terms are often interchangeable, but the specific naming and requirements may vary by jurisdiction.

The Bylaws of a corporation also bear resemblance to the Articles of Incorporation. While the Articles serve to create the corporation legally, the Bylaws outline how the corporation will operate internally. They detail the rules governing the organization, including the roles of directors and officers, meeting protocols, and voting procedures. Together, these documents create a framework for both the legal existence and the operational governance of the corporation.

The Partnership Agreement is another document that shares some similarities with the Articles of Incorporation, particularly in terms of establishing a business entity. This agreement outlines the terms under which two or more individuals will operate a business together. Like the Articles, it includes essential details such as the business name, responsibilities of each partner, and profit-sharing arrangements. Both documents are critical for defining the structure and expectations of the business entity.

The Certificate of Good Standing, while different in purpose, is related to the Articles of Incorporation. This document is issued by the state to confirm that a corporation is legally registered and compliant with state regulations. It serves as proof that the corporation has fulfilled its obligations, such as filing annual reports and paying necessary fees. Both documents work together to establish and maintain the corporation's legal status.

The Statement of Information is another document that often accompanies the Articles of Incorporation. This statement provides updated information about the corporation, such as its business address, officers, and registered agent. While the Articles of Incorporation create the entity, the Statement of Information keeps the state informed about its current status. Both are essential for ensuring transparency and compliance with state laws.

The Business License is similar in that it is required for a corporation to operate legally within a specific locality. While the Articles of Incorporation establish the corporation at the state level, the business license is typically issued at the city or county level. It ensures that the business complies with local regulations and ordinances. Both documents are crucial for a corporation to function legally within its jurisdiction.

The Operating Agreement, often used by LLCs, is akin to the Bylaws of a corporation. This document outlines the management structure and operational procedures of the LLC. While the Articles of Incorporation establish the entity, the Operating Agreement provides the rules for how it will be run. Both documents are vital for defining the governance and operational framework of their respective entities.

The Federal Employer Identification Number (EIN) application is another document that is related to the Articles of Incorporation. While the Articles establish the corporation, the EIN is necessary for tax purposes and to open a business bank account. This number is issued by the IRS and is essential for any corporation that plans to hire employees or engage in certain financial transactions. Both documents are integral to the legal and operational aspects of running a business.

Lastly, the Annual Report is similar in that it is a document required for maintaining good standing with the state after incorporation. While the Articles of Incorporation are filed to create the corporation, the Annual Report must be submitted regularly to update the state on the corporation's activities and status. Both documents ensure that the corporation remains compliant with state regulations and can continue to operate legally.

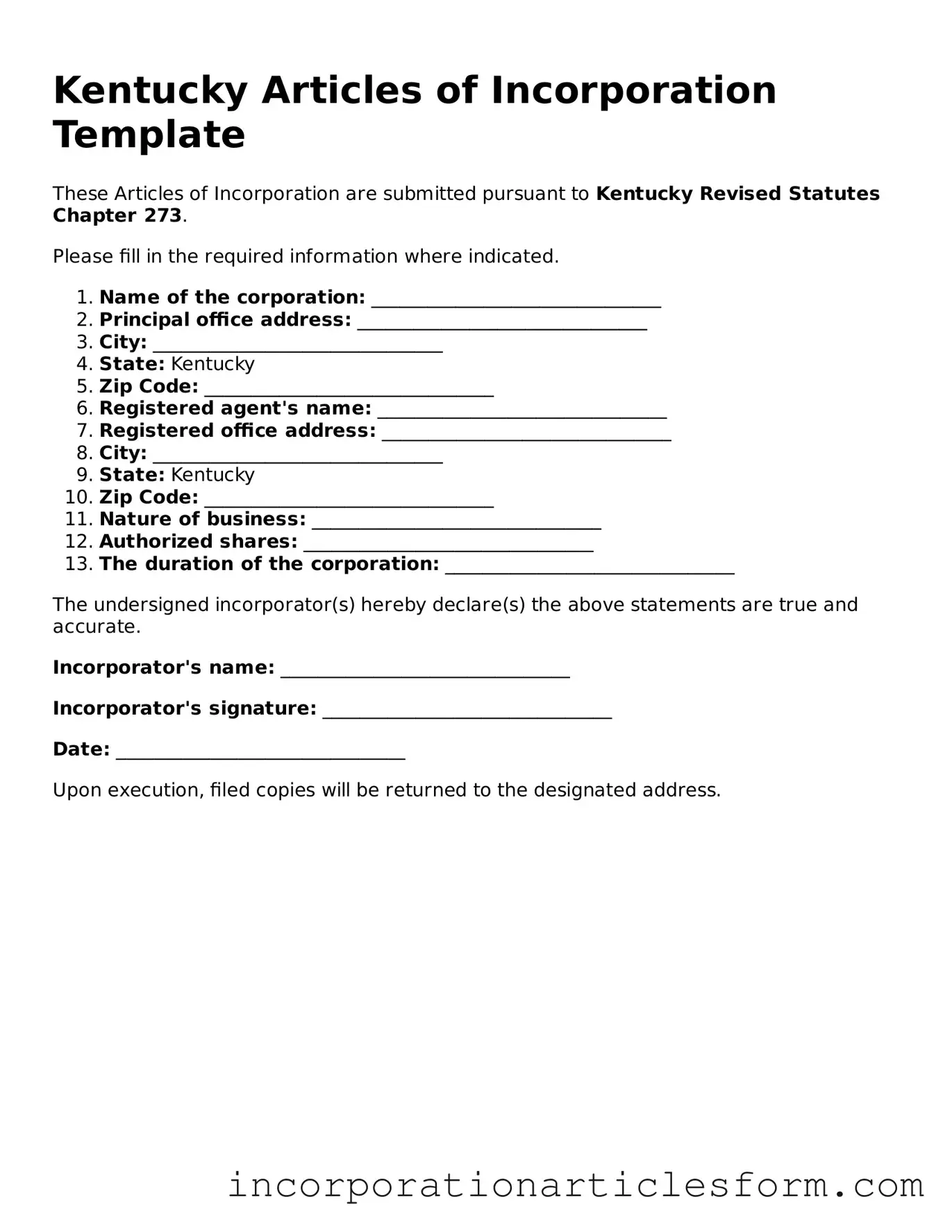

Document Preview Example

Kentucky Articles of Incorporation Template

These Articles of Incorporation are submitted pursuant to Kentucky Revised Statutes Chapter 273.

Please fill in the required information where indicated.

- Name of the corporation: _______________________________

- Principal office address: _______________________________

- City: _______________________________

- State: Kentucky

- Zip Code: _______________________________

- Registered agent's name: _______________________________

- Registered office address: _______________________________

- City: _______________________________

- State: Kentucky

- Zip Code: _______________________________

- Nature of business: _______________________________

- Authorized shares: _______________________________

- The duration of the corporation: _______________________________

The undersigned incorporator(s) hereby declare(s) the above statements are true and accurate.

Incorporator's name: _______________________________

Incorporator's signature: _______________________________

Date: _______________________________

Upon execution, filed copies will be returned to the designated address.

Some Other Articles of Incorporation State Forms

Utah Corporation Search - Can serve as a prerequisite to obtaining licenses and permits needed to operate.

Cost to Incorporate in Delaware - Articles can be amended for changes in corporate structure or plan.